Why overlooking risks is a primary threat to survival.

A recent study from BCG highlights how managers and executives, despite their experience, can be overconfident about risks. It reminds us that caution in decision-making is always necessary.

Consumer and industrial companies expect supply chain disruption to be the driving risk of their businesses. However, the reality is far different:

Bodyshop filed for Chapter 7 liquidation in the US after facing rising costs and competitive pressures. It could not sustain operations because it did not see how markets were changing.

Hydration and sports drink company BioSteel filed under the Companies Creditors Arrangement Act in Canada and Chapter 15 in the US. The company struggled with liquidity issues as it attempted to expand its European operations. A sustainable scaling-up framework was underestimated.

Consumer companies fail because they need a clear vision for the future and take unnecessary and unmitigated risks.

The bipolar approach to risks further supports this evidence: cyber-threats are at the top of the list of concerns for C-suites. However, geopolitical conflicts seem to worry nobody, despite the trade impact that the War in Ukraine had on grain supply and the effect of Middle Eastern conflicts on trade.

Why can seeing risk only as a threat hold you back?

In the BCG survey, 80% of respondents admitted they see risk primarily in a negative or neutral light. This reveals a critical blind spot: viewing risk as a threat keeps organizations from seizing unforeseen opportunities that can lead to bold moves and genuine market disruption.

When we think of risk, we often think of defensive strategies—mitigating loss and protecting stability. But what if we reframe that mindset? Think of risk as an untapped reservoir of potential. Technological changes can introduce innovation opportunities, create new offerings, or position you as a first mover in a shifting market landscape. Purposeful disruption isn't just about reacting to change; it's about driving the change that sets you apart.

If you wait until the dust settles before moving, you might already be too late. Consider leveraging your advantaged position to innovate, create partnerships, or even push for regulatory changes that align with your vision. Whether acquiring an emerging competitor to solidify market power or enhancing customer engagement through strategic differentiation, the growth potential often lies at the intersection of risk and vision. Ultimately, entrepreneurship is about taking calculated risks.

How well are you preparing for the future you can't yet see?

For many organizations, risk management feels like a game of catch-up—reacting to disruptions as they unfold. But what if you could anticipate and even shape these disruptions before they become realities?

This is where strategic foresight transforms risk management into a proactive, opportunity-driven capability.

Strategic foresight isn't about predicting the future with certainty; it's about building an organizational mindset that anticipates multiple potential futures so you're ready for whatever comes. It provides a structured way to look beyond the immediate horizon, protect value, and actively create it. This shift in mindset—from reactive to proactive—allows companies to capitalize on emerging trends before they become mainstream, giving them an edge in crafting new opportunities.

Consider a market poised for technological disruption. With strategic foresight, a company can do more than protect its market position—it can pivot early, embrace new technologies, and shape its future trajectory to become a leader in that change. For instance, in my work in global expansion, I followed a tiered international growth strategy. It wasn't just about navigating risk; it was about defining the terms of engagement.

By investing in strategic foresight, companies improve their ability to respond to shifts in their sector and set the foundation for advantageous decision-making—operationally in the short term and strategically in the long term. Those anticipating disruptions are better equipped to adapt and influence their environments rather than merely reacting to them.

How is your company preparing to navigate and shape the future?

Weak Signals: Can GLP-1 change the future of food and beverage?

GLP-1 Ozempic is an anti-diabetes medicine that is also prescribed in the US as a weight loss medication. Patients report an average weight reduction of 10% within the first six months of usage.

Ozempic works by mimicking a naturally occurring hormone. As those hormone levels rise, the molecules go to your brain, telling it you're full. It also slows digestion by increasing the time it takes for food to leave the body. This is similar to the effect of bariatric surgery

However, GLP-1 also changes how consumers perceive taste: According to recent medical research, patients who take the medication are less likely to eat sweet and hyper-processed foods. Moreover, another study posits that hyper-processed foods, high-sugar sodas, hyper-glycemic foods, and refined grains increase the likelihood of unpleasant side effects while on GLP-1.

Because of these scenarios, financial analysts are asking stock-market-listed food and beverage corporations and their ingredient suppliers how C-suites will mitigate those risks, which will require a landmark shift in product portfolio and product technology.

The GLP-1 Hurricane: F&B is not alone

According to Vogue, GLP-1 medicines will have significant impacts on the Fashion industry as well as cosmetics:

Fashion may just see a windfall. As Ozempic use grows, GLP-1s will provide "structural tailwinds" for the apparel industry, wrote Deutsche Bank analyst Adam Cochrane in a note, as users refresh their wardrobes following Ozempic-induced weight loss. According to the Bank of America, consumers are expected to refresh their wardrobe "for every two size changes."

"'Expect to see growth in formulations containing ingredients like retinoids, peptides, and hyaluronic acid, known for their ability to boost collagen production and improve skin texture,' says scientist and medical physician Ekta Yadav."

What other industries could be impacted? Your guess is as good as mine, but at first sight:

On-premise: Restaurants (especially fast food chains) and cafeterias

Gym/Fitness: increased Fitness of the general population

Consumer Health Care: changing needs and drivers

Retail/ Grocery Shopping: with shopping trips changing in shape and objectives

...

A simple example of Strategic Foresight Capabilities

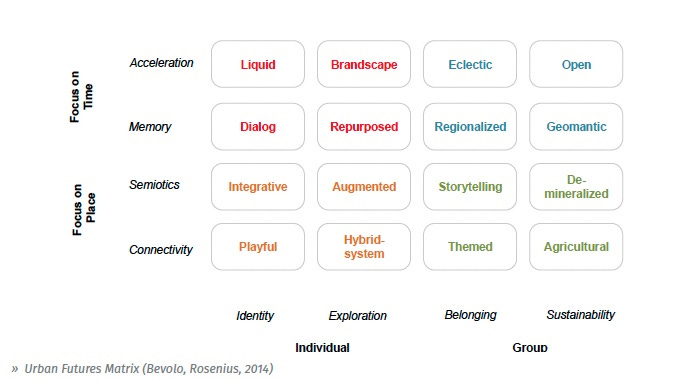

Together with Marco Bevolo, I developed a study on the Blurrification of Consumption. At the core of the research was a strategic forecast model Marco had developed in his previous academic research.

In this paragraph, I will simplify the process to give an easy-to-access framework for anybody to start building Strategic Foresight Capabilities. Mind you, this is neither complete nor the end game: if it were a digital course, this would be the equivalent of explaining how to set up your social media accounts.

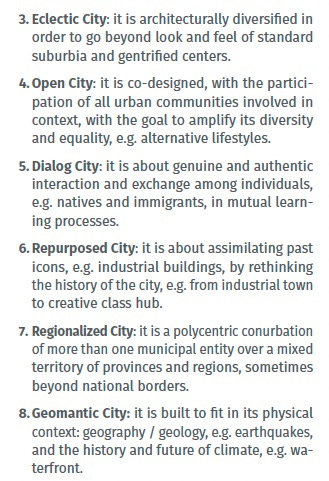

NB: if you are unfamiliar with the terminology, follow this simple guide.

1) Monitor Weak Signals and Consumer Trends

Focus on real influencers and opinion leaders, not influencers for sale. Track your consumers' appetite for change through social listening.

Social listening is one of the most underutilized tools in a marketer's arsenal. In an age where consumers openly share their preferences, frustrations, and desires across social platforms, brands that fail to tune in need a wealth of opportunities. It's not just about monitoring mentions or counting likes—it's about understanding the deeper conversations that shape how your brand is perceived and, ultimately, how you can grow.

Consider a brand that effectively listens. It doesn't just react to complaints or praise; it draws insights that shape its strategy. It identifies emerging needs, spots shifts in sentiment, and discovers subtle cues about unmet desires in the market. Listening is not passive. It's active research—a way to co-create with your audience rather than simply broadcasting to them.

Social listening is how we uncover patterns that data alone can't reveal. It tells us why people feel like they do and how our brand can fit seamlessly into their lives. It's about connecting in a meaningful, timely way—not only to respond but also to predict and preempt, to shape our products and messages before the market even realizes it needs them.

The question isn't whether you're tracking your brand mentions. It's whether you genuinely listen to the stories, insights, and shifts unfolding right before you.

2) Build a Matrix

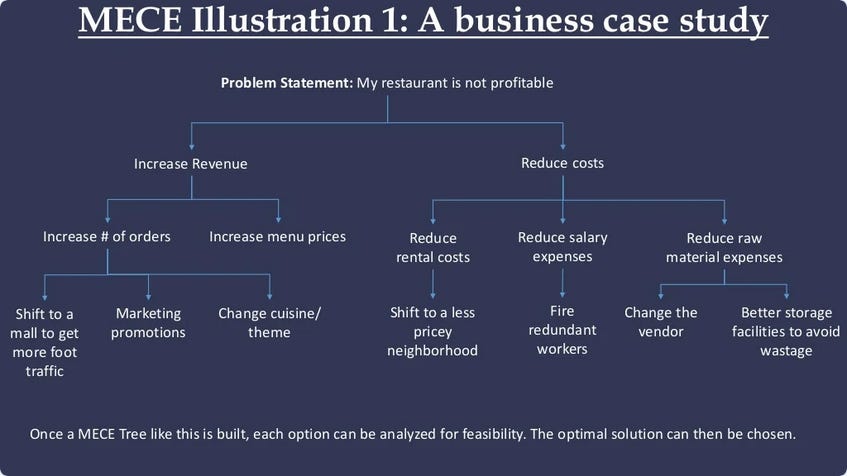

Building a 2x2 or 3x3 Matrix is the stepping stone of the future scenario. To quote McKinsey, the framework needs mutually exclusive and collectively exhaustive - MECE. How do you go about it? By building for each dimension of the Matrix a tree, like in the profitability example here:

(Source: https://www.slideshare.net/slideshow/mece-framework-for-structured-thinking-code-ground/68975818)

This is the (very complex and sophisticated) example of the Urban Futures Matrix we used for our research on the Blur.

Needless to say, the more scenarios, the larger the effort and the more complete the framework. But as usual, it is a trade-off between completeness and effort, as well as benefits and costs.

3) Co-create each scenario

At the intersection of the Matrix, a future scenario emerges and needs to be documented. The most confusing part is that the future does not exist, so it cannot be researched. We will have to imagine it. It would be best if co-created with relevant consumers, experts, and stakeholders.

4) Cluster Scenarios in a relevant way

If you have more than 6, it is a good idea to cluster scenarios together to reduce the number of elements you consider in your foresight. Still, it will grant you the ability to go deeper when necessary.

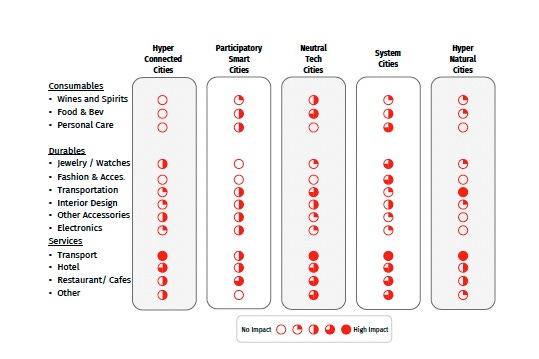

5) Evaluate the impact of each scenario on your business, industry, sectors, or functions.

In Conclusion

Overlooking risks is not just about failing to prepare for potential threats—it's about missing out on opportunities to innovate, evolve, and lead. The examples of Bodyshop and BioSteel demonstrate how underestimating changing market dynamics can have devastating consequences. However, reframing risk as a source of possibility rather than solely a danger can help organizations move from reactive crisis management to proactive, opportunity-driven strategies. By adopting strategic foresight, building a culture of agility, and leveraging weak signals, companies can position themselves to withstand disruptions and shape the future to their advantage. The real question for any business today isn't just about mitigating risks—it's about using them as a springboard to create new value and lead their industries forward. Ask yourself this question: Do you want your company to last or not?