Introduction

The Gatorade brand has an energizing history that dates back to 1965. It all started at the University of Florida, where researchers set out to create a formula to help the university's football team, the Gators, maintain their strength and performance during games, particularly in the sweltering heat. They developed a carbohydrate-electrolyte beverage that effectively replenishes the fluids and electrolytes lost through sweat and provides energy to exhausted muscles.

The drink's success with the Gators was just the beginning. By the late 1960s, Gatorade had caught the attention of both collegiate and professional sports teams. The brand achieved a milestone by becoming the official sports drink of the NFL in 1983, an affiliation that significantly boosted its visibility and adoption across various sports disciplines.

Throughout the decades, Gatorade continued to innovate, introducing new flavors, formulations, and products aimed at hydration and nutrition for athletes. The brand has become synonymous with sports performance, with a product line that extends beyond drinks to include energy bars, protein powders, and other athletic supplements.

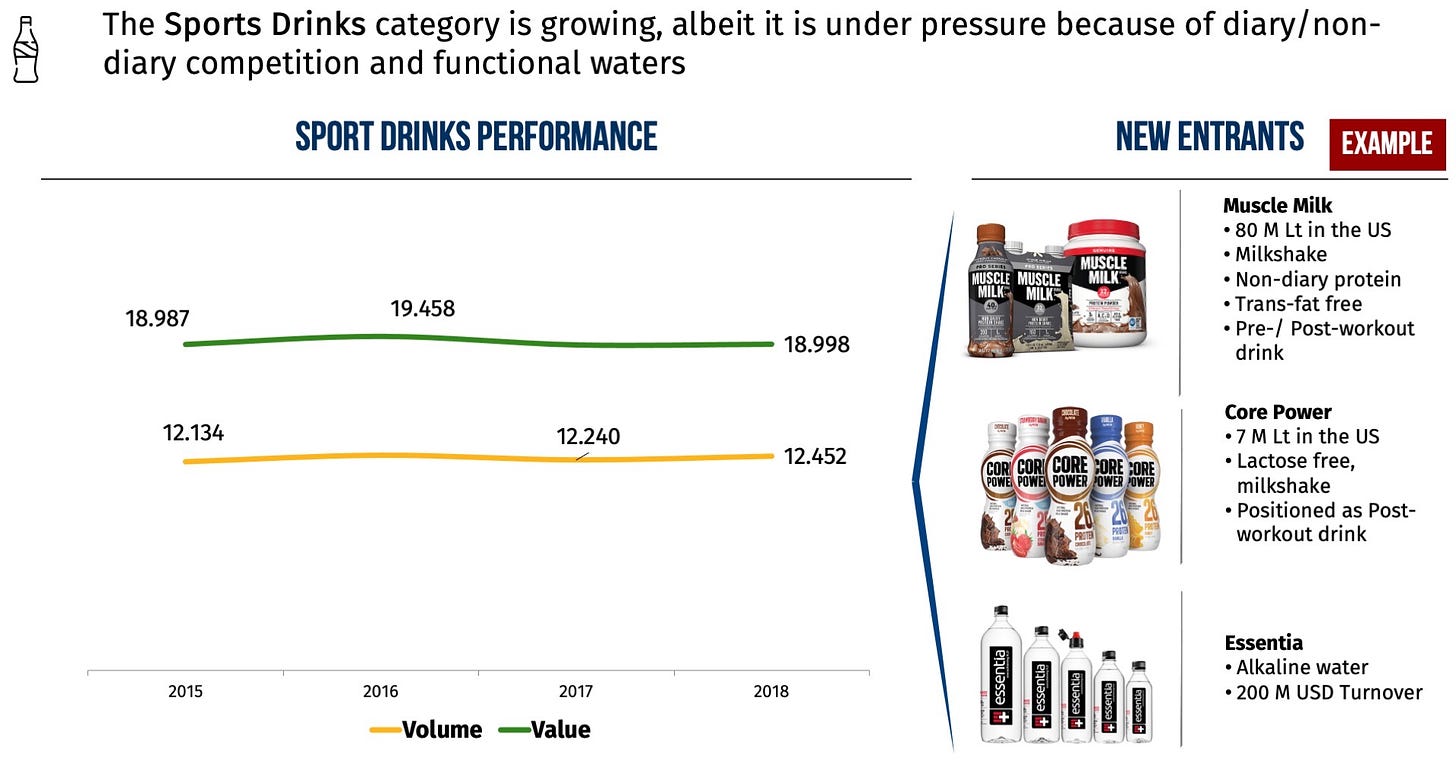

Only recently, and not without controversy, did Gatored decide to launch unflavored water into their franchise. Why would they abandon the category they once created to launch a water? Because for more than a decade, the sports hydration category has been blurring. On one end, non-diary protein beverages have entered the pre-/post-workout consumption occasion to take a share of the hydration market. Conversely, more and more functional codes have embraced the sports categories codes and eaten some of the Gatored-created categories with alkaline or electrolytes-infused waters.

Gatored is effectively adapting to the competition’s shifts in a blurred category.

Understanding the 'Blurred Reality'

While consumers do not look at categories as compartmentalized as manufacturers and distributors do, traditionally, food and beverage marketing and salespeople focus on categories at the boundary of their focus and as a border to their actions. This approach has limited perceived competition between wines and spirits, vodkas and whiskies, and sodas and beers. In the Blur, those boundaries disappear, and competition traditionally comes from players in adjacent categories. Gatorade created a blue ocean by developing a new category beyond the traditional role water played for sports hydration, which is now being challenged by similarly functional waters. Low-ABV Flavored Beers and Cider compete with sodas in high-volume eating occasions, which surprised large soda producers that deemed alcoholic products less healthy than theirs. The emergence of the NoLo categories, especially of the Non-alcoholic spirits, and the mainstreamization of vegetable-protein-based meat alternatives are among the clearest examples of the blurrification of consumer markets.

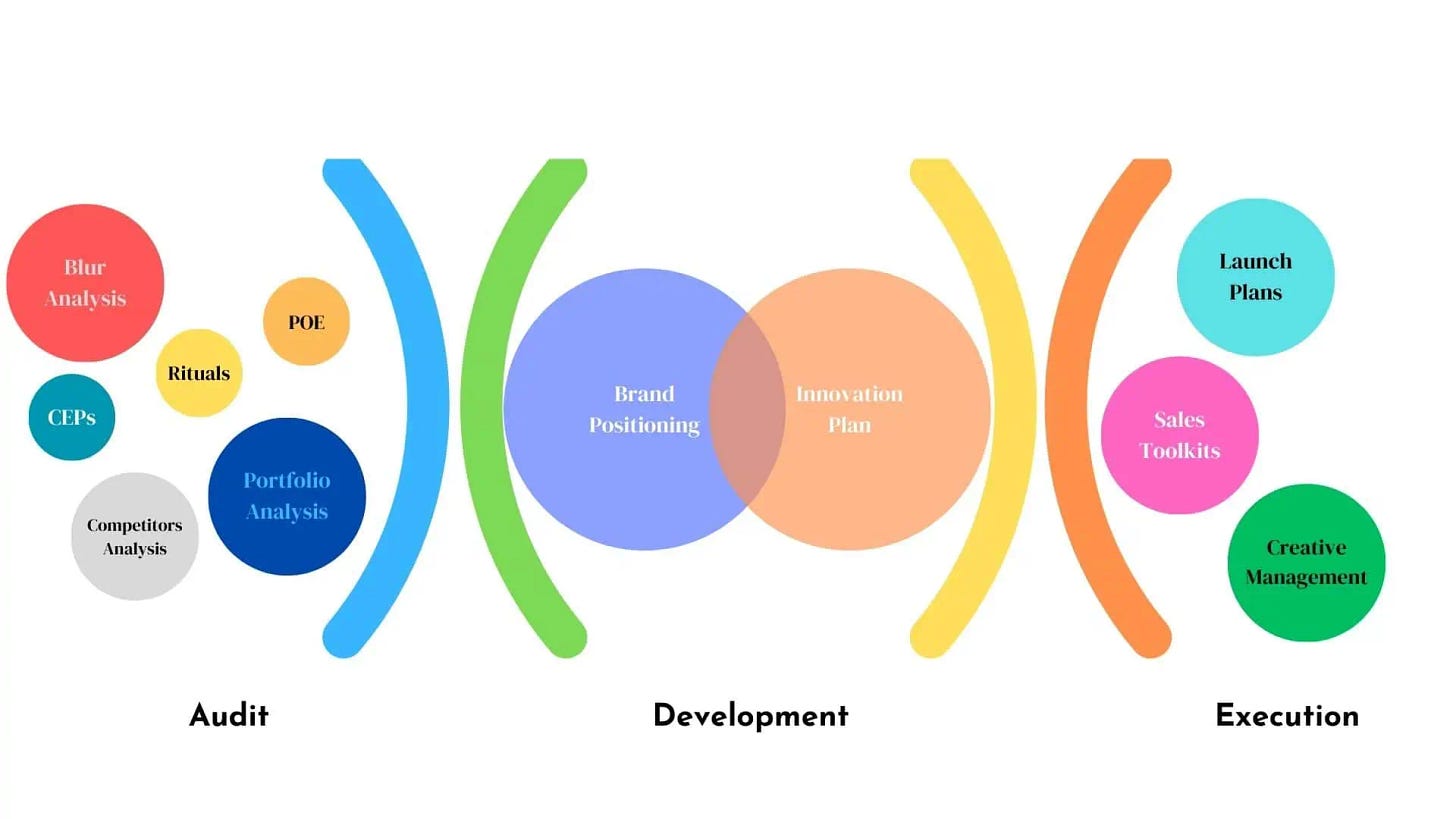

(1) The Audit Phase - Laying the Groundwork

In today's food and beverage market's complex, blurred tapestry, our transformation begins with a foundational stage, the audit phase, where we dissect four key areas: Blur Analysis, Rituals, Competitors Analysis, and Portfolio Analysis. Each of those analyses is a diagnostic deep dive to match emerging trends and their so-what for the brand.

(1. a) Blur Analysis: Addressing the challenges of a non-binary market

The F&B market is no longer a space of clear-cut segments and predictable consumer behavior. It's a vibrant blend of crossover trends, fusion flavors, and lifestyle-driven choices. In this blur analysis, we look at how F&B brands can identify their unique space within this blend. It's about understanding that health-focused consumers might also indulge in comfort foods or recognizing that premium products can attract budget-conscious buyers when positioned as occasional treats. The trick is to see the market as segments and understand the overlaps and what they mean for your brand.

(1. b) Rituals: How Consistent Habits Shape Product Success

In a blurred market, consumer rituals are a beacon for emerging trends. The evolution of the Aperitivo all'Italiana into the Apericena in Milan in the late 90s created a ritual ripe with weak signals for brands. Aperol, the re-emergence of cordials and other bitters, and the renaissance of Vermouth were all weak signals of that ritual.

This stage is also essential for identifying potential rituals brands could own and use as platforms for their transformations.

(1. c) Competitors Analysis: Keeping ahead in a shifting landscape

With the playing field constantly changing, keeping an eye on the competition is more important than ever. This is not about tracking market share or promotions. It's about backward engineering their moves. We delve into competitive intelligence to uncover what others in the space (and adjacent ones) are doing and identify opportunities for differentiation. This means looking at direct competitors and adjacent categories that might infringe on your consumers. This phase is more about weak signals than long-term trend analysis.

(1.d) Portfolio Analysis: Evaluating product mix for market fit

Last but not least, we look inward at your portfolio. What's working? What's not? And most importantly, why? This analysis goes beyond sales figures; it's about understanding how each product fits into the current market landscape—and where it might fit tomorrow. We assess your product lineup's resilience, shortcomings, prospects, and threats to ensure your portfolio is diverse and dynamic enough to weather market shifts and consumer mood swings.

For (1. e) Category Entry Points and (1. f) Point of Entry Marketing, I'll refer you to our published white paper or this Substack post.

In the next post, we will cover the Development Phase and the Execution Stage.