Introduction

Scaling up is a crucial phase for consumer goods, food, and beverage start-ups, just like for tech companies. However, once these start-ups have established a profitable business and operational model in the tech world, they are eager to accelerate their growth and reach commercial success.

Scaling up in consumer industries requires a significant transformation. It's about stepping out of the comfort zone of initial success and embracing change to fuel rapid growth.

This transformation often involves operational and supply chain-related changes. In many food and beverage cases, this could mean adopting new strategies such as licensing or co-packing, where growth comes from delegating some parts of manufacturing and distribution. The hard truth is that in the same country, a winning strategy in a channel does not necessarily translate into cross-channel success. Not with the right mindset, not with the proper thinking. When start-up consumer products companies move beyond the boundaries of - what is most likely their - single-channel success, they embrace large audiences but leave behind some of their first-hour customers and consumers who no longer identify with the brand. Becoming more mainstream often results in losing appeal to those early adopters.

Prerequisite of Scaling-up

While we will not focus on the supply chain side, whose considerations inevitably stem from the status quo, the category, and the region where the company operates, some common patterns exist among successful FMCG start-ups. Most often, consumer goods and food and beverage start-ups get some traction in one of these three cases:

1) they have a local community of followers and a 2Ps marketing approach, focusing on product and price as a substitute for promotion and placement. Often reached through a channel alone: on-premise, D2C, normal trade;

2) they have a category-centric viewpoint, which reflects industry norms but not consumer insights and trends;

3) they have a local gem, a good combination of a rising brand and a great product portfolio;

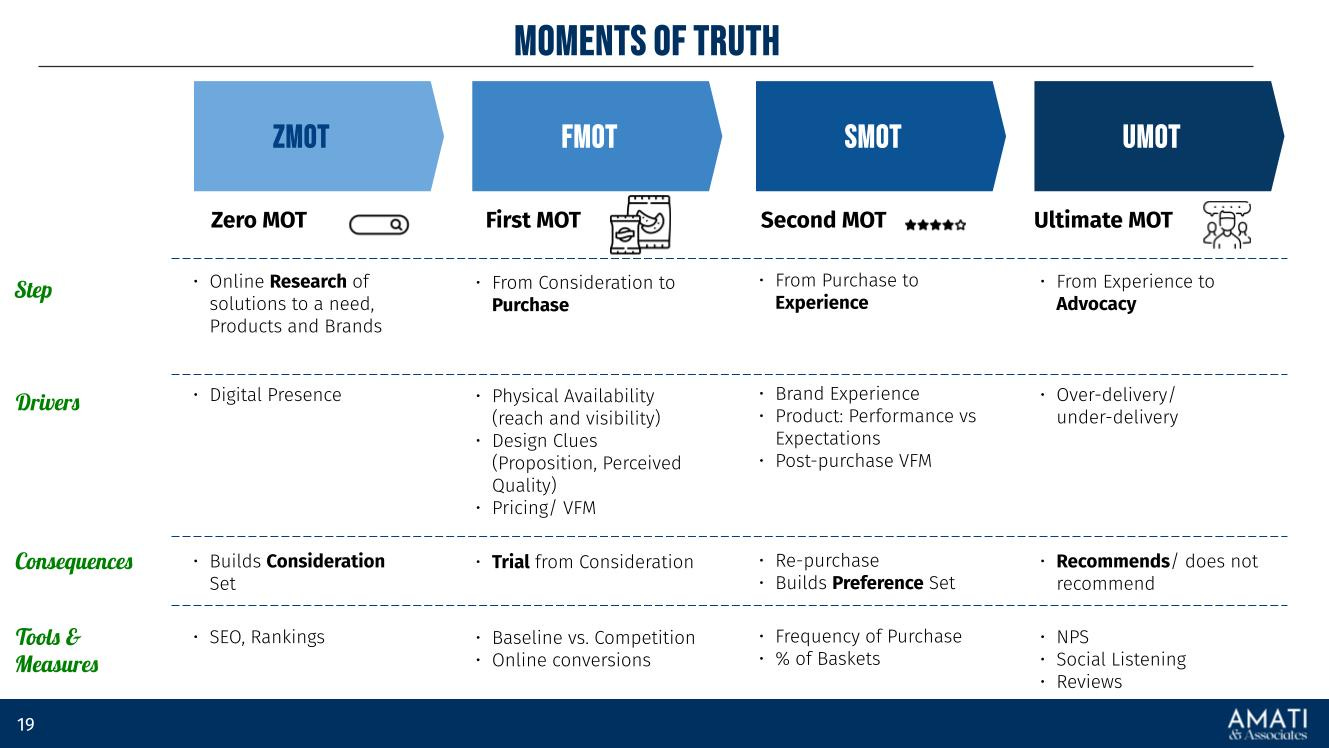

In each case, the companies need to embark on a transformation that readies them for scaling up: from robust and proprietary consumer insights to a clear brand promise matching the perceived benefits of the product portfolio (First and Second Moment of Truth), from a well-positioned brand to solid 4Ps marketing foundations with clear target consumers, target source of volume, target occasions; from sell-in and sell-out data and understanding of precise category dynamics. This transformation requires some inner-soul searching, for example, understanding the reality of the value chain and how to elevate pricing to a strategic tool. But also - and primarily - it's an outside-in journey where consumers and competitors play a critical role.

The Art of Scaling-up

Principles:

Great products are necessary but not sufficient to scale up.

The best products in the market only help if they deliver on the expectations set by your brand.

Consumers need products but purchase brands.

Building brands takes time, and no money can accelerate that. More money is better than no money.

Brand Trust is not for sale.

Successful scale-ups in consumer goods embrace the essence of "saying no' to spreading too thin on multiple fronts.

A strategy has value only if it is executable, not if it looks good on slides in the boardroom.

Look at other scale-up brands as an inspiration rather than a me-too strategy; you have better chances of winning the lottery than successfully growing by copycatting someone's plan.

Approach

As explained earlier, there is a significant difference between scaling up a tech company and scaling up a CPG firm: the first is ready when operationally sounds and has an operating model that works. The latter will have to change its operating model to scale. I once heard from a gentleman during a conference that a start-up is a flight simulator in FMCG, whereas a scale-up is a small plane. I can't entirely agree with that view, but I agree with the gap between the two stages. Continuing with the aviation metaphor, any CPG firm ready to scale up must address a pre-flight checklist.

So, in our scale-up framework, we identify High-Priority Vectors — a sort of pre-flight checklist. Skipping them is a significant contributing factor to accidents and failure. As they say, better safe than sorry!

Then, we propose two Nice-to vectors, which might be relevant or not, but they could really change your brand's future landscape when relevant.

Finally, we focus on Growth Vectors such as improving distribution, Reach, and internationalization.

High-Priority Scale-up vectors

The High-Priority Scale-up vectors are the activities driving growth that must be addressed before scaling investments. Particularly when ready to move from a single-channel to a multi-channel approach or when interested in growing internationally. Some will be more or less relevant depending on the category and products:

1) Zero Moment of Truth

Consumers research the products and categories, even consumer goods and perishable foods. And that research happens online. Google calls it the Zero Moment of Truth, as the research happens before the actual purchase. The ZMOT aims to help consumers introduce their brands to the consideration set. Being visible online is often linked to selling online. Still, online visibility is increasingly linked to trials in traditional and on-premise channels.

Examples of ZMOT in Action:

Product Reviews and Ratings: Consumers read online reviews and watch comparison videos on YouTube before purchasing new products. The information gathered during this phase influences their choice of brand and model.

Social Media Influence: A potential buyer discovers a new skincare line through influencer posts on Instagram. The positive mentions and demonstrations they see form a favorable impression, prompting them to seek more information on the brand's website.

Search Engine Queries: the origin of the ZMOT, often linked to lateral opportunities. So, for example, the "What are the best recipes for tagliatelle pasta?" could lead to the discovery of new brands of tagliatelle, new recipes/new sauces, and parmesan/ cheese add-ons. By looking for wines similar to the Austrian Grüner Veltliner, I discovered the Terlan Gewurztraminer or "Traminer Fruttato" - in its Italian fashion - quickly became our go-to wine for the summer.

In each of these examples, the Zero Moment of Truth is crucial in shaping consumers' perceptions and preferences before purchasing. By understanding and optimizing the ZMOT, brands can effectively influence consumer decisions, steering them towards a positive First Moment of Truth.

2) First Moment of Truth

FMOT was initially coined by Procter & Gamble in 2005. It captures the first interaction between a customer and a product in retail, whether in-store or online. FMOT is the decisive instance when a consumer stands before a product and contemplates purchasing, making it a crucial battlefield for brands competing for their hearts and wallets.

Explanation of FMOT:

FMOT occurs when a consumer encounters a product at the point of sale – on the shelf or online, on a menu in a restaurant, in the back bar, or at the barber store – marking the transition from consideration to decision-making. At this juncture, the product's design, packaging, visibility, and presentation must work hardest to convert interest into action. The FMOT is influenced by the consumer's prior knowledge and expectations, often shaped by the ZMOT, and it is the brand's opportunity to make a compelling case for why their product is the superior choice.

The Impact of Packaging, Presentation, and Visibility:

The FMOT is heavily influenced by several factors, with packaging, presentation, and visibility at the point of sale taking central roles. Attractive, clear, and engaging packaging can draw the consumer's eye amidst a sea of competition, conveying the product's benefits and differentiators at a glance. In-store, strategic placement on shelves—at eye level or high-traffic areas—can significantly increase product visibility and engagement. In other channels, such as the on-premise, visibility on the menu, back bar, tables, and staff recommendations is vital. Online, clear, high-quality hero images and videos, along with detailed product descriptions, serve a similar purpose by providing a virtual "shelf presence" that invites exploration and consideration.

Strategies for Optimizing FMOT:

Enhance Packaging Design: Invest in packaging that stands out and succinctly communicates the brand's values and the product's benefits. Use colors, textures, and imagery that attract the target demographic while ensuring the packaging is functional and user-friendly.

Optimize Placement: Work with channels to secure optimal locations for your products. In-store displays and end caps can also provide visibility and attract more attention to your products.

Improve Online Presentation: Ensure that your product listings online include high-resolution images from multiple angles, engaging product videos, and detailed, keyword-rich descriptions.

Leverage In-Store and Online Promotions: Use promotions, discounts, and special offers to entice potential buyers during the FMOT. Highlight these promotions prominently on product packaging and in online product listings.

Focus on Consumer Education: Provide clear information on product benefits, usage instructions, and additional value propositions through packaging inserts, in-store displays, or detailed online product pages and FAQs. Addressing any lingering consumer questions or concerns can help tilt the scales in your favor.

By thoughtfully addressing each of these areas, brands can create a more compelling First Moment of Truth, turning casual browsers into committed buyers and laying the groundwork for further growth.

3) Product - Brand Binomial / Second Moment of Truth

One of the most significant drivers of brand trust loss is the byproduct of products that do not deliver against expectations. Every time consumers buy a product, they have brand-induced expectations (e.g., brand promise), which the product might or might not deliver against. That could be due to quality or just dissonance between an oversold expectation and performance.

This gap creates a double jeopardy effect: on one end, consumers will be less likely to repeat the purchase anytime soon. This also means that if the brand invests in promotional activity to subsidize the first purchase, this activity will yield differently than planned. Conversely, consumers will not only not become advocates for the brand but are likely to share their negative opinions, fueling negative word-of-mouth, which will slow the recruitment of new consumers and shoppers.

How do you reduce the gap? By working on product performance and brand expectations, we can better overlap them. Sometimes, it is enough to use the packaging to better educate consumers on how or when to (occasion) use the product. Sometimes, the brand promise must be tuned better with the product's performance if the binomial is still compelling, relevant, and unique enough in the competitive landscape.

Most often, the brand promise and the product require creative re-engineering.

Tips for Ensuring a Positive SMOT through Quality and Service:

Prioritize Product Quality: Improve your product to ensure it meets and exceeds customer expectations. Regular quality checks and updates based on customer feedback can help maintain high standards.

Play the expectations game: This stage is about performance vs. expectations. Even with the quality of the product, if the promises made are unreachable, the outcome of the experience will always be positive. To win at this stage, you must over-deliver your brand promise.

Solicit and Act on Feedback: Regularly gather customer feedback through surveys, social media, and direct communication. Use this feedback to make informed improvements to your product or service, demonstrating to customers that their opinions are valued and acted upon.

Create an Experience: Remember that the SMOT isn't just about the product but its overall experience. Pay attention to packaging, unboxing experiences, and any additional touches that can make using the product feel special.

4) Category Entry Points (CEPs)/ Consumption Occasions

Category Entry Points (CEPs): Situations or contexts prompting consumers to consider a specific product category. In the food and beverage industry, CEPS are usually called consumption occasions. For example, feeling thirsty might trigger thoughts of soft drinks or water.

While CEPs drive substantial mental availability, marketers also use them to fuel product visibility and discoverability in the proper channels, positively impacting Physical Availability.

How do you build a CEP? By looking at the following dimensions:

Persona: The leading actor, the target consumer.

Motivation: Their interest or purchase includes functional needs and emotional desires.

Emotion: The consumer's emotional state at the point of engagement.

Locale: The physical or digital space where the transaction or engagement occurs.

Companionship: Identifying if the consumer is alone or with others and what that implies for the buying decision

Activity: What the consumer does during the engagement, providing context to the consumption.

5) Portfolio-Channel Fit

This exercise is among the toughest for a company to go through. Before scaling, you must ensure that your product portfolio fits enough with the channels you want to target. While this sounds simplistic enough, counterintuitively, most companies need more time to be ready on this front. A few years back, I was conducting a training session for a leading consortium of food producers, and the Portfolio-Channel Fit was revealed to be the most significant barrier for most of those companies. Some consortium members had, at best, a 30-40% format overlap with the typical formats of the markets and channels they were ready to attack. Focus is essential, and SKU proliferation is a clear sign of trouble. Still, the portfolio-channel fit needs to address the question of Total Addressable Market: most companies choose a channel or export to a country because their category sales are in the billions. Yet, they build portfolios that can target, at best, a single-digit percentage of that market. In that specific case, the TAM related to the 30-40% portfolio channel overlap was around 5% of the market. While this is an art more than science, this growth vector drives a choice between:

Either developing SKUs that maximize the TAM while keeping the focus on the strategy.

Or maintaining the SKUs but looking for better TAMs

Of course, supply chain and gross margin considerations play an essential role in this approach.

Nice-to Scale-up Vectors

The Nice-to vectors can be game-changers in the long run. Still, they depend on the category and our ability to connect with consumers. Nevertheless, these are growth-accelerating levers that have been paradigm-shifting for many long-lasting brands:

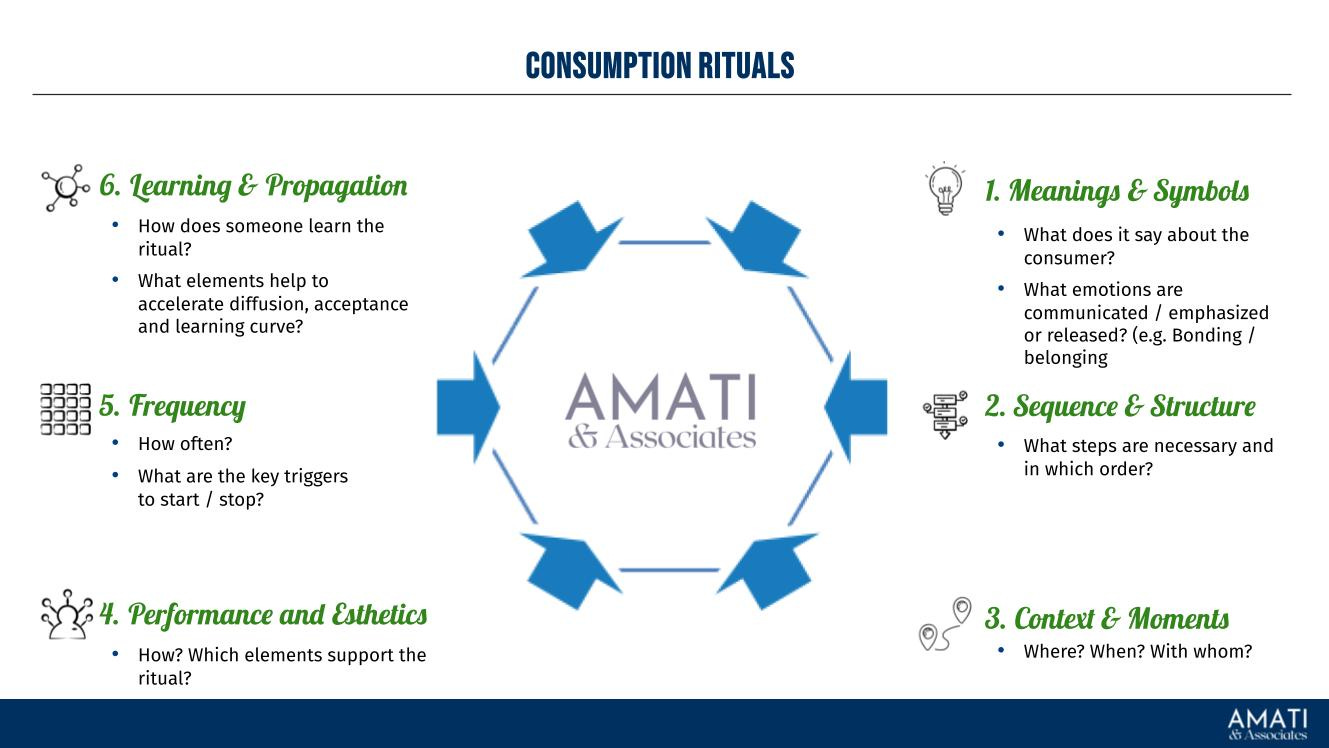

6) Consumption Rituals

Consumption rituals elevate everyday moments into meaningful experiences. Unlike mere habits, these rituals involve a blend of routine actions and emotional engagement, turning the use of a product into a significant event. Here's the essence:

When consumers participate in rituals around a product, they perceive it as higher in quality and value.

Rituals, purposeful acts, introduce a satisfying anticipation to the consumption that heightens enjoyment.

Active participation in rituals, rather than passive observation, significantly boosts the pleasure derived from consumption.

The deep involvement required by rituals enhances enjoyment and imbues the consumption experience with greater significance.

This nuanced view highlights how rituals transform consumption into an enriching experience by integrating routine with emotion, deepening the consumer's connection to the product.

The Consumption Rituals Framework outlines seven dimensions to understand how rituals enrich consumer experiences:

Stars and Guest Roles: This section identifies critical ritual participants, from individuals to groups, and highlights their roles and characteristics.

Context and Moments: This section focuses on the setting and timing of rituals, emphasizing their purpose in transitioning consumer moods.

Meanings and Symbols: Explores rituals' contributions to community, order, and societal transformation.

Frequency: Considers how often rituals occur, impacting strategic marketing implications.

Sequence and Structure: Look at the detailed actions and sequences of rituals.

Performance and Aesthetics: Examines the role and design of ritual objects, enhancing symbolic meanings.

Learning and Propagation: Discusses how rituals are discovered, learned, and spread.

This framework helps marketers craft strategies that resonate deeply with consumers by aligning with their meaningful rituals.

7) Point of Entry Marketing

When a consumer becomes open to a new product or category, often due to life changes, an example is starting a fitness regime, making someone more receptive to gym memberships or healthy foods. Many brands use in-gym visibility to reach the radar screen of prospective consumers interested in their offering (e.g., supplements, training accessories). PMEs are mostly related to life changes and life stages.

These are typical questions necessary to identify a PME:

What life events or changes typically precede interest in our category or product? Examples: a newborn for Pampers.

At what moments do consumers realize they need a solution like ours? Example: Planning to buy a house and mortgage brokers.

Which information sources do potential customers turn to first when seeking solutions in our category? An example is wedding Magazines for wedding planners.

Which professionals recommend our category? Example: Healthcare prescription frameworks for health-related ailments.

Growth Vectors

These vectors are your ultimate focus on accelerating growth. Suppose your offering thicks all the pre-flight checklist boxes. In that case, you are ready to build further distribution, improve Reach, and start exporting to new markets.

8) Improving Distribution

There are two untold laws in the sales of Consumer Products: 1) consumers cannot willingly buy a product/brand they are unaware of; 2) shoppers can't buy a product that is not available for selling where they want to buy it.

FMCG Scaling is usually about getting your feet in serious retail operations and thriving in them. The name of the game is sales velocity per outlet!

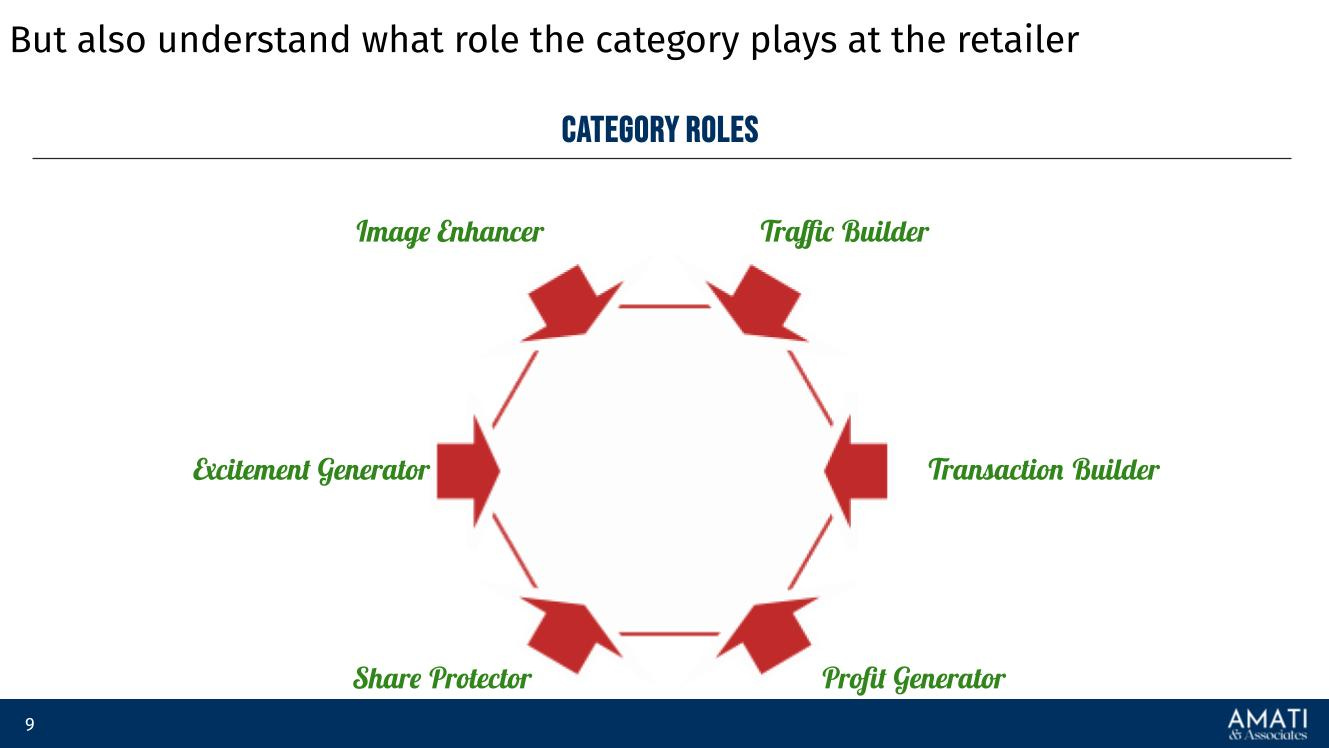

Modern Trade and Category Management

Category Definition:

Defining the category by understanding its role in the market is crucial, including packaging, size, and pricing norms. This involves identifying category codes that govern product perception, including price structures and attributes.

Competitive Dynamics:

Successful category management requires assessing competitive forces. This includes differentiating between leaders and followers, understanding market concentration, and tracking emerging trends that could affect competition.

Merchandising:

Effective merchandising involves not only product placement but also range and display strategies. Planograms, shelf placement (e.g., top shelf, eye-level), and promotional activities like end caps or impulse zones are vital to increasing product visibility and sales.

Category Dynamics:

Shopper behavior and mission types (e.g., quick visits vs. stock-up trips) significantly impact category penetration and purchase frequency. Understanding these dynamics is critical for positioning the product effectively within the category.

Value Proposition:

Your product's contribution to the category should be clearly defined. It should challenge existing norms or offer added benefits, such as health attributes or sustainability. A strong value proposition distinguishes the product within competitive and merchandising contexts.

Trends and Future Developments:

Critical macro trends influencing category management include sustainability, health-conscious consumption, and blurring industry boundaries. These trends can shape how products are developed and marketed in the future.

9) Improving Reach

It is not casual that I do not use the "building awareness" sentence; instead, I speak of Reach. When consumers know your brand's existence or product but do not understand or recall it, purchasing cannot happen. Pure awareness is information lost in the clutter of all other stimuli our brains receive. Brand building and improving Reach have a high barrier to entry. A good advertising campaign has high production costs, and advertising is generally expensive. Embracing it requires a commitment to a long-term game. Data proves that sudden A&P spending increases - in developed countries and the post-COVID-19 era - seldom bring results in the following two quarters. This is less true when starting from nearly nothing, but true nonetheless.

Here are reach-building sub-vectors, with examples of scale-up and emerging CPG brands in the US and Europe that are benchmarks in each category:

Sponsorship: Support any event with its pre-existing Reach to build a brand with those audiences. The bigger the event, the more expensive the partnership. More importantly, sponsorships should be activated, so budgets should be available to buy in and execute the activation. Examples:

DUDE Wipes 250: In 2024, DUDE Wipes became the title sponsor of the DUDE Wipes 250 race at Martinsville Speedway, part of NASCAR's Xfinity Series. This marks the first time DUDE Wipes has held an entitlement sponsorship for a NASCAR event, reinforcing their commitment to the sport.

Liquid Death: This canned water brand sponsors music festivals and extreme sports events, aligning its edgy branding with subcultures to reach niche but loyal audiences. The brand sponsors Metallica's ongoing M72 World Tour (2023-2024), providing interactive experiences for concert-goers. This includes a custom "cooler coffin" for sampling, photo ops, and post-show product giveaways. Over 160,000 cans have been distributed so far.

Creative Partnerships: from paid or free product placements to collaborations with platforms and events already penetrating relevant audiences. Examples:

Minor Figures: The oat milk brand partnered with independent coffee shops and artists, building its identity around the coffee culture and supporting local communities while creating co-branded, limited-edition products.

Recess: The CBD-infused sparkling water brand has formed partnerships with wellness and mental health platforms, combining product placement with content that resonates with health-conscious, wellness-focused consumers.

Liquid Death: it has also collaborated with figures like Martha Stewart, who created a candle shaped like a dismembered hand, and Tony Hawk, who launched a skateboard deck infused with his blood. These partnerships align with the brand's edgy and untraditional image.

Experiential: it focuses on creating engaging, memorable experiences for consumers to interact with a brand. Unlike traditional marketing, which relies on conveying information, experiential marketing aims to immerse consumers in an interactive experience, fostering a deeper emotional connection with the brand. Create for generating PR and free publicity. Examples:

Seedlip: This non-alcoholic spirit brand creates pop-up bar experiences emphasizing mixology and social settings without alcohol, introducing consumers to new ways to enjoy the product in a social atmosphere.

Haus: The modern aperitif brand hosts intimate tasting events and dinners at exclusive locations. It focuses on building connections with small groups of influential customers to create a premium experience around its products.

Traditional Advertising. Examples:

Ugly Drinks: Ugly Drinks, a sparkling water brand, has used direct mail campaigns and out-of-home (OOH) advertising (e.g., bold billboards) to build brand recognition, particularly in urban areas where its health-oriented message stands out.

Guerrilla Marketing: An unconventional marketing approach that uses surprise or creative tactics to promote a product or service in public spaces, with minimal budget but maximum impact. The goal is to generate buzz and capture the audience's attention in a memorable and often unexpected way.

Tony's Chocolonely: Tony's Chocolonely has launched four limited-edition chocolate bars in the UK, Netherlands, Belgium, Germany, and the US, modeled after famous chocolate brands like Kit Kat, Toblerone, Twix, and Ferrero Rocher. These bars are part of the "Sweet Solution" campaign, which advocates for human rights legislation to address modern slavery and child labor in cocoa supply chains. However, the campaign has faced challenges, with some significant chocolate companies pressuring retailers to remove the products from shelves.

Liquid Death: all they do falls under the guerrilla umbrella!

These emerging brands show how scale-ups can creatively use limited resources to substantially impact sponsorships, partnerships, experiences, and traditional advertising.

10) Export Sales

International sales require a specific approach beyond the occasional "moving boxes" order. We suggest you download our dedicated white paper on exports free of charge.

Conclusion

Scaling up for consumer goods, food, and beverage start-ups presents challenges and opportunities. While transitioning from start-up to scale-up requires significant operational and strategic shifts, success lies in embracing change and staying agile. Companies must understand their category dynamics, establish a clear value proposition, and adopt a consumer-first approach. By optimizing their approach to marketing moments such as the Zero and First Moments of Truth and ensuring the product matches the brand promise, start-ups can unlock the growth necessary to become mainstream players. Ultimately, those who balance vital consumer insights with efficient operations and targeted expansion strategies will be better positioned to scale successfully while maintaining brand integrity and trust.